Condo Insurance in and around Chinook

Chinook! Look no further for condo insurance

Protect your condo the smart way

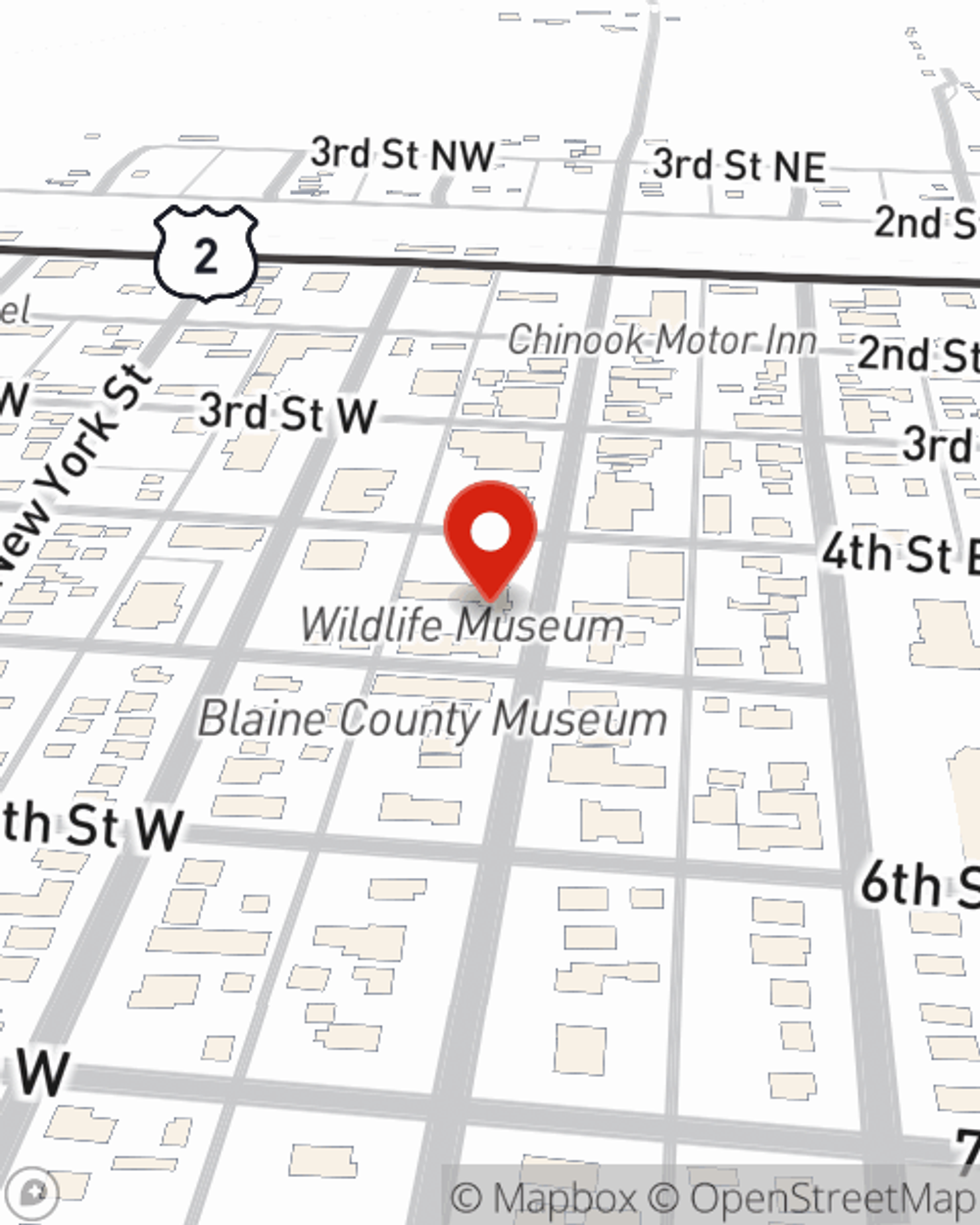

- 425 Indiana Street

- Chinook, MT

- Malta, MT

- Harlem, MT

- Fort Belknap, MT

- Havre, MT

- Turner, MT

- Zurich, MT

- Hogeland, MT

- Dodson, MT

- Glasgow, MT

- Saint Marie, MT

- Idaho

- North Dakota

- Wyoming

- Montana

There’s No Place Like Home

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm uncomplicated. As one of the top providers of condominium unitowners insurance, you can enjoy remarkable service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like cookware, home gadgets and souvenirs.

Chinook! Look no further for condo insurance

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo from fire, vandalism or an ice storm.

As a value-driven provider of condo unitowners insurance in Chinook, MT, State Farm helps you keep your home protected. Call State Farm agent Crystal Stepper today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Crystal at (406) 357-3198 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Crystal Stepper

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.